Slide 1

Access to finance is consistently reported to be the biggest challenge faced by last mile distributors. We work alongside members and funders to tackle this challenge.

Despite last mile distributors’ (LMDs) relative success in fundraising – with 62% of GDC members having raised grant, debt and/or equity between 2019 and 2022 – access to finance remains the top challenge; particularly for local companies. To unlock the full potential of the LMD sector all types of funding are needed. While funders are increasingly exploring ways to invest further downstream and support smaller companies, as well as local companies, the reality remains that capital is still not flowing into the space at the rate required – and the capital that is flowing, is not sufficiently inclusive or tailored to the LMD sector’s needs.

1. We generate data, research and insights to explore what the trends and gaps are in the LMD capital continuum, and to help investors better understand LMDs’ fundraising and growth journeys, to recognise that profitability is not always linked to scale;

2. We enable structured dialogue (amongst investors, as well as between investors and distributors) to inform investor decision-making and support those investors focused on the LMD sector to raise funds; for example via our 2021 and 2022 LMD Investor Forums;

3. We develop bespoke tools and resources to support LMDs get investment ready and raise funding.

What? A set of tools to help early-stage last mile distributors consider what they need funding for, which funders to approach, and how to develop a great pitch.

Why? To equip LMDs with guidance to more effectively engage with funders, in order to scale their businesses and impact.

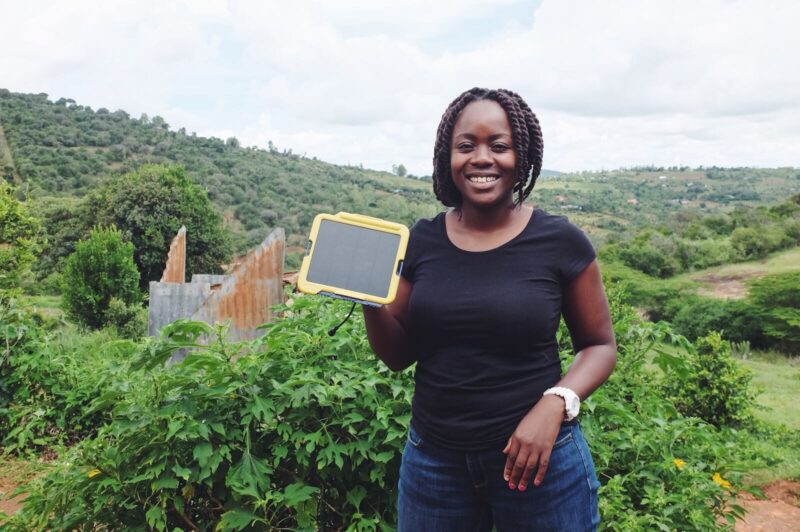

What? A video series showcasing the growth and impact stories of three GDC members and their partners

Why? To spotlight the important role of intermediary investors in channelling investment into the LMD sector; unlocking much-needed finance for companies while enabling their own investors to achieve financial and impact goals.

These knowledge outputs were funded with UK aid from the UK government via the Transforming Energy Access programme; and GET.invest, a European programme which aims to mobilise investment in decentralised renewable energy, supported by the European Union, Germany, Sweden, the Netherlands and Austria.

GDC members are invited to register to be able to leave suggestions and reviews (your account will provide access to member-only resources in the future)